|

|

Order by Related

- New Release

- Rate

Results in Title For depreciation

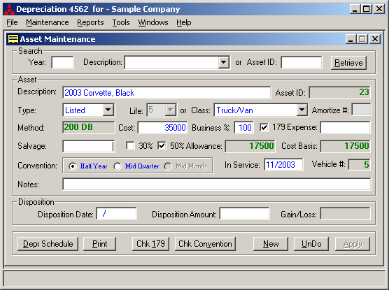

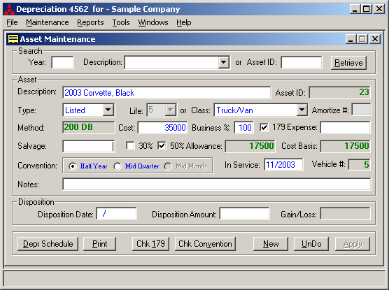

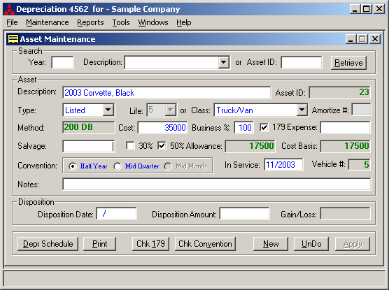

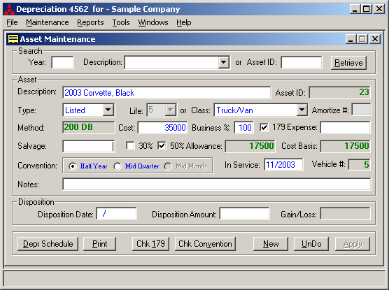

| Depreciation 4562 is an extremely efficient way to calculate Federal Tax Depreciation. Form 4562 is computed with a minimum amount of input. This is an idea tool for a tax professional, CPA, or anyone needing to complete tax depreciation. Asset data information is retained in a database for use in preparing future tax returns. An unlimited number of Companies or Clients can be maintained. Depreciation 4562 was created for the tax preparer that needs to do federal tax reporting, but does not need the expense and complexity that most depreciation application have.

All depreciation and amortization methods required for federal tax reporting is included in an easy to use format. Extensive On-Line Help details methods and tax requirements.

Some of the features of Depreciation 4562

Computes and prints Form 4562.

Calculates Luxury Automobile Depreciation.

Tracks Section 179 deductions and limits.

Determines the 30 or 50 percent Special Depreciation Bonus.

Checks to see if mid quarter convention is required.

Nine comprehensive reports are provided.

Easy customization of asset classes simplifies asset input.

New maximum automobile amounts can be input to stay current with changing tax regulations. A formal depreciation schedule can be printed. Half-year, mid-quarter, and mid-month conventions are provided. Depreciation is generated using IRS tax tables.

The following depreciation methods are supported

ADS

Amortization

MACRS - 200 DB

MACRS - 150 DB

MACRS - Straight-Line

Straight - Line .. |

|

| Depreciation 4562 is an extremely efficient way to calculate Federal Tax Depreciation. Form 4562 is computed with a minimum amount of input. This is an idea tool for a tax professional, CPA, or anyone needing to complete tax depreciation. Asset data inf ..

|

|

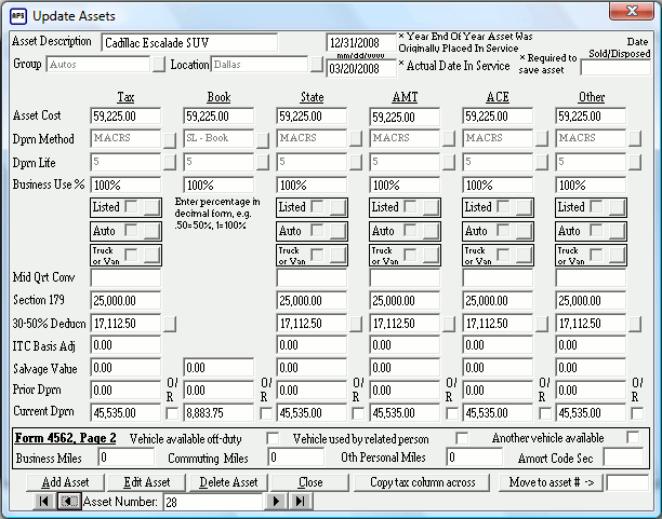

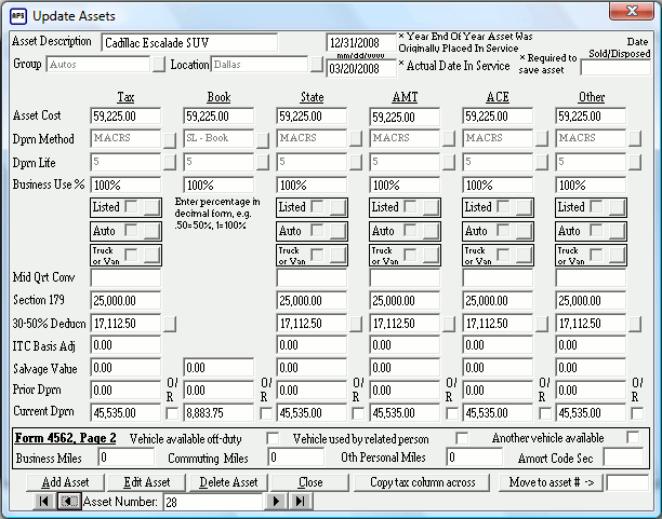

| AcQuest Pro Depreciation. Windows XP, Vista. & Windows 7. Fed, GAAP, state, AMT, and ACE depreciation for multiple companies. With demo years cannot be rolled forward. Supports most deprecation methods. .. |

|

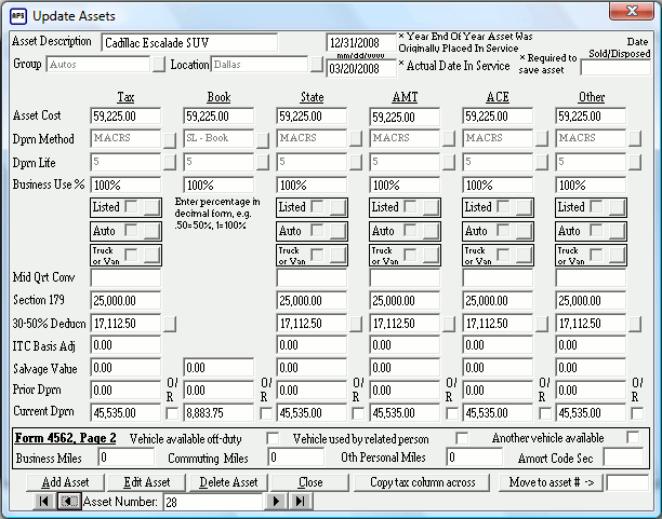

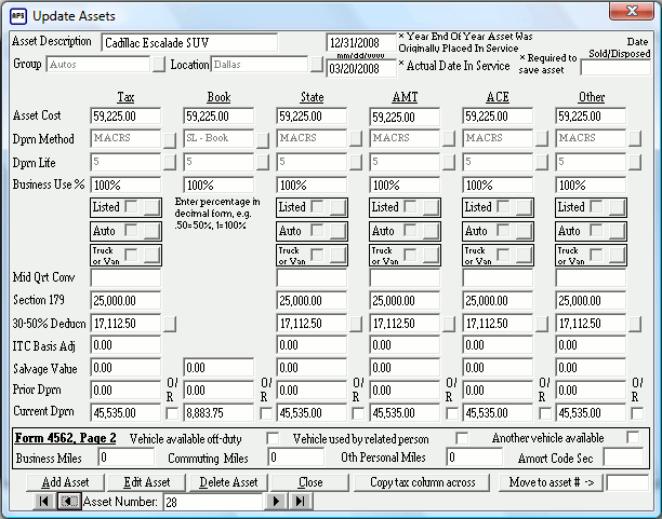

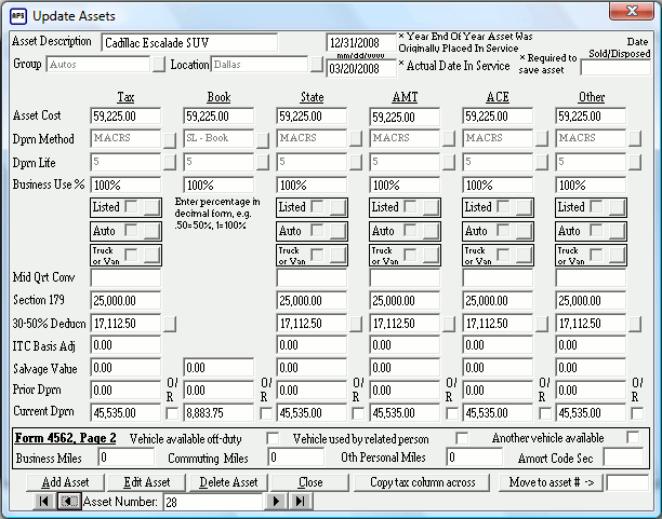

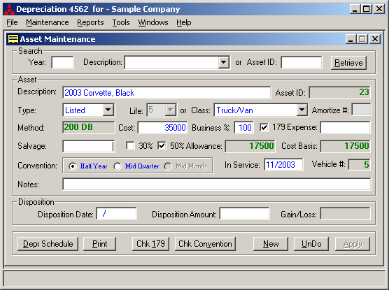

| Depreciation 4562 Pro is a complete fixed asset system which includes book and tax depreciation, management reporting, and asset tracking. Current tax rules for depreciation are built in, to guide you through the process of adding assets to meet federal requirements. All depreciation and amortization methods required for federal tax reporting is included in an easy to use format. Extensive on-line help details methods and tax requirements. This cost-effective software was designed to meet your business needs. You can create an unlimited number of companies and assets. Fixed Assets can be classified by asset type, class, general ledger account, or location. Detail information is tracked by asset. There are twelve standard reports, which can be preview or printed. Some of the features of Depreciation 4562 Pro Easy customization of asset classes simplifies asset input. Most reports can be produced for any period, historical or future. Supports fiscal years ending in any calendar month. Keeps track of Tax and Book depreciation. Multiple users are supported Unlimited FREE technical support is included. Supports an unlimited number of companies and assets. A Sample Company and data are included to reduce the learning curve. Auto calculation of accumulated depreciation to aid in conversion of assets from a different application. Depreciation is generated using IRS tax tables. Eight comprehensive tax reports are provided. Five standard Book reports are included. Produces monthly journal entry for book depreciation. New maximum automobile limits can be input to stay current with changing tax regulations. Backup Wizard makes it easy to backup valuable fixed asset data. Keeps track of assets by location. Maintains notes on each asset. A formal depreciation schedule can be printed. Compliant with all federal tax requirements. ..

|

|

| AcQuest HQ Depreciation. Windows XP, Vista, & Windows 7. Fed. and GAAP depreciation. With shareware version, open years cannot be rolled forward. Supports most deprecation methods. .. |

|

| Depreciation 4562 Pro is a complete fixed asset system which includes book and tax depreciation, management reporting, and asset tracking. Current tax rules for depreciation are built in, to guide you through the process of adding assets to meet federal r ..

|

|

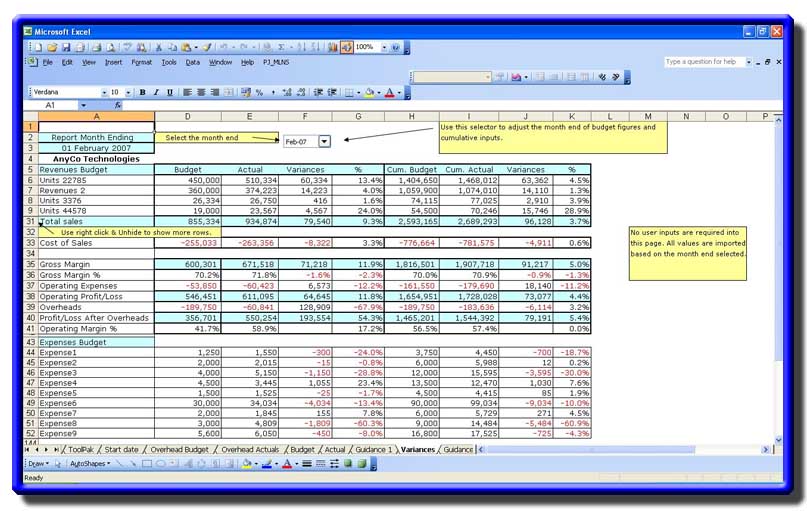

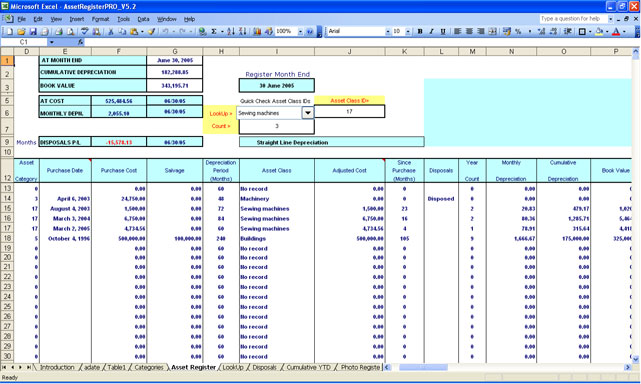

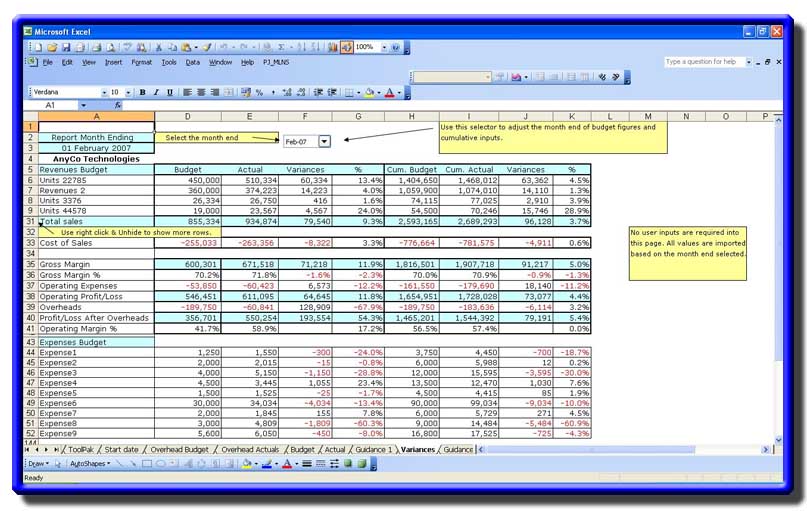

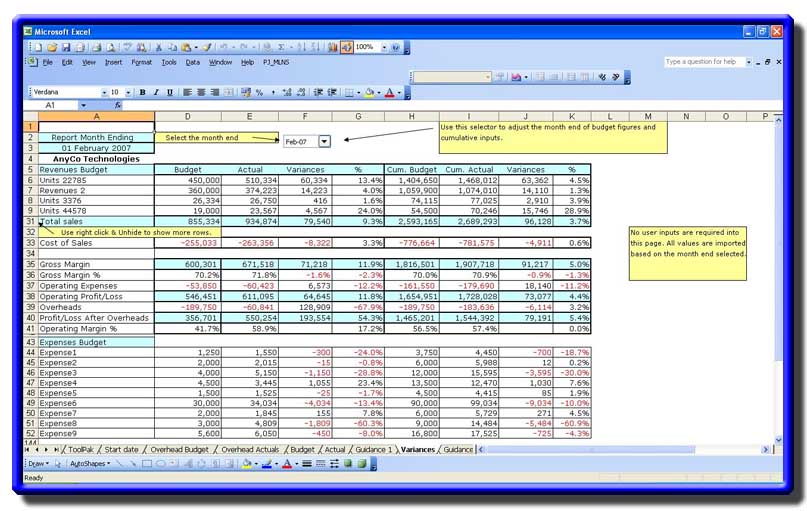

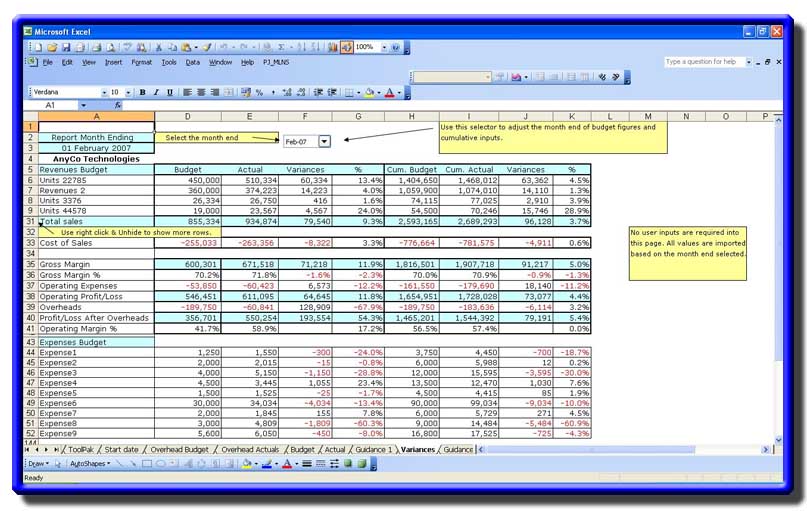

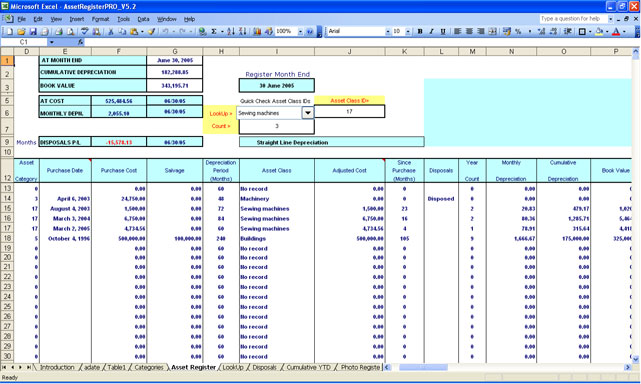

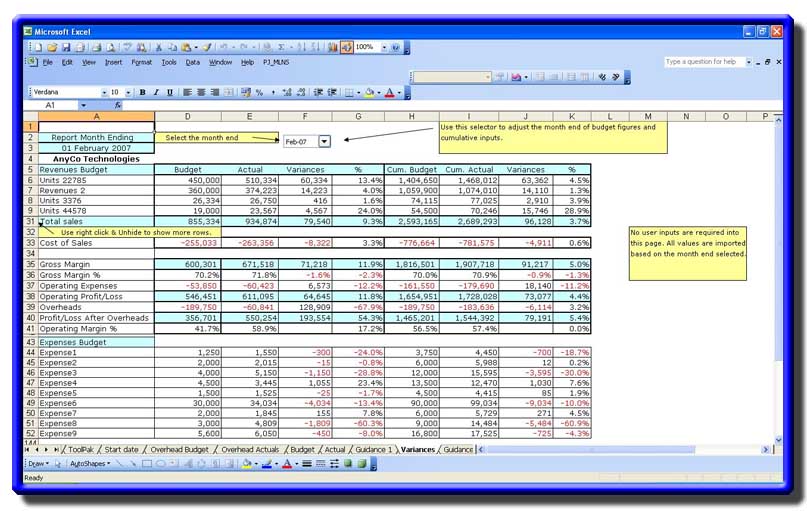

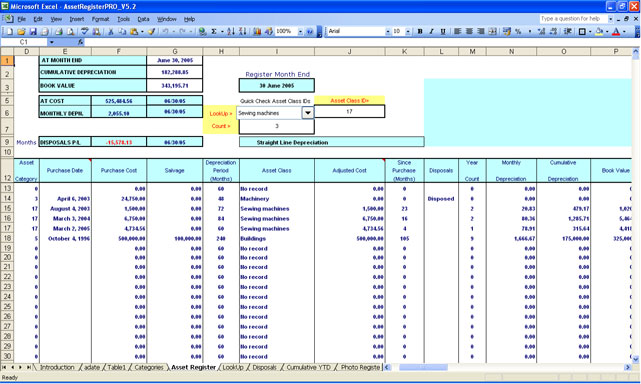

| Asset Register PRO for Excel supplies nine asset registers plus YTD depreciation reports for fixed, intangible and investment assets, updating and reporting depreciation calculations and book values at each month end. Each asset entered into the register can contain the asset sequence number, date of purchase, description of asset, serial number, supplier's name, purchase order number, G/L reference code, accounting cost, useful life (depreciation period), physical location, plus if/when disposed/sold and gain/loss calculations and impairment ledgers for investments, intangibles and goodwill. Asset Register PRO can be used by the smallest to the largest enterprise to keep track of their assets and monthly depreciation calculations. Asset Register PRO applies the straight-line depreciation method, and the declining balance method adjusted annually and monthly. Depreciation tables supply monthly depreciation and cumulative depreciation from the acquired date to any period up to 240 months.

Quick and easy entry of assets into the registers using Excel's Data (Entry) > Form with the Name box.

Asset Register PRO provides continuous month end sequencing so that the asset class registers update each asset depreciation and book value every month automatically and combines all month end values into a Year To Date and Totals report. Different depreciation periods can be applied to individual assets and within each class of assets.

Asset Register PRO calculates book values at disposal dates and gain/losses on disposal.

All month end depreciation calculations and book balances can be recalculated backwards and forwards to any month end date by making a simple one step adjustment to the month end date held in the adate field. You can recalculate and forecast depreciation totals and written down balances for any month end past or future. Such calculations can be very useful for preparing financial business forecasts and for checking depreciation calculations. .. |

|

| SuperPro Asset Depreciation can save hundreds of dollars on accounting fees. Insures that you are maximizing you depreciation benefits. Reports include a depreciation detail and summary report and a year beginning and ending report. The progam will prduce your IRS forms #4562, Part 11 for current year and Part 111 for prior years and the IRS #4797, Part 1, Sale of Property form. Provides an easily readable detail screen for each asset and show the total depreciation for each. This program requires some knowledge of IRS income tax and depreciatioin .. |

|

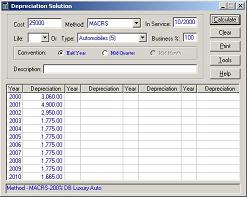

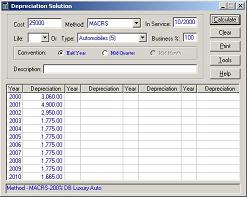

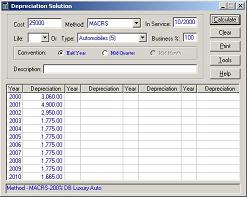

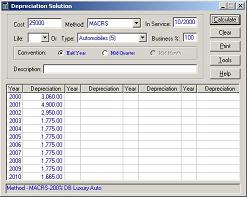

| Depreciation Solution is an extremely easy way to calculate Federal and book depreciation. All depreciation and amortization methods required for federal tax reporting are included in an easy to use calculator format. Extensive on line help details methods and tax requirements.New maximum automobile amounts can be input to stay current with changing tax regulations. A formal depreciation schedule can be printed. Half-year, mid-quarter, and mid-month convention are provided. Depreciation is generated using IRS tax tables.This is an ideal application for a CPA, or anyone doing tax schedule 4562, justify capital purchases, or manually booking depreciation.The following depreciation methods are supported: ADS Amortization MACRS - 200 DB MACRS - 150 DB MACRS - Straight-Line Straight -Line .. |

|

Results in Keywords For depreciation

| Depreciation 4562 Pro is a complete fixed asset system which includes book and tax depreciation, management reporting, and asset tracking. Current tax rules for depreciation are built in, to guide you through the process of adding assets to meet federal r.. |

|

| Depreciation 4562 is an extremely efficient way to calculate Federal Tax Depreciation. Form 4562 is computed with a minimum amount of input. This is an idea tool for a tax professional, CPA, or anyone needing to complete tax depreciation. Asset data inf..

|

|

| SuperPro Asset Depreciation can save hundreds of dollars on accounting fees. Insures that you are maximizing you depreciation benefits. Reports include a depreciation detail and summary report and a year beginning and ending report. The progam will prduce your IRS forms #4562, Part 11 for current year and Part 111 for prior years and the IRS #4797, Part 1, Sale of Property form. Provides an easily readable detail screen for each asset and show the total depreciation for each. This program requires some knowledge of IRS income tax and depreciatioin .. |

|

| AcQuest Pro Depreciation. Windows XP, Vista. & Windows 7. Fed, GAAP, state, AMT, and ACE depreciation for multiple companies. With demo years cannot be rolled forward. Supports most deprecation methods...

|

|

| AcQuest HQ Depreciation. Windows XP, Vista, & Windows 7. Fed. and GAAP depreciation. With shareware version, open years cannot be rolled forward. Supports most deprecation methods... |

|

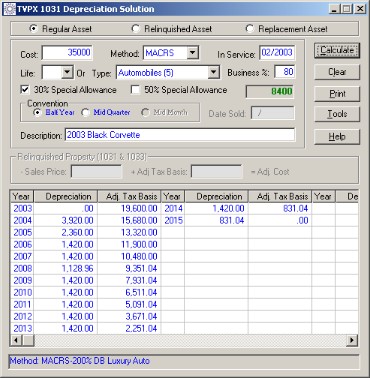

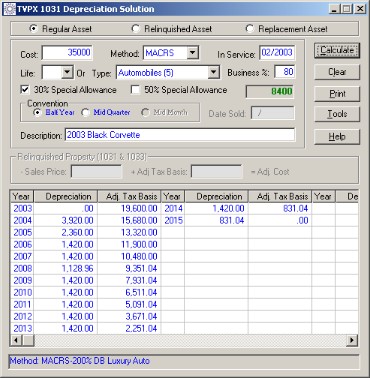

| TVPX 1031 Depreciation Solution is an extremely efficient way to calculate federal and book depreciation. All depreciation and amortization methods required for federal tax reporting are included in an easy to use calculator format. By filling in a few fields, the user can quickly produce a depreciation schedule for a fixed asset.

TVPX 1003 Depreciation Features

Calculate the adjusted tax basis of replacement property purchased as part of a Like-Kind Exchange under IRS Section 1031.

This is an ideal application for a CPA, or anyone doing taxes, justifying capital purchases, or manually booking depreciation.

A formal depreciation schedule can be printed for an asset.

Current tax rules for depreciation are built in, to guide you through the process of adding assets to meet federal requirements.

Extensive on-line help details methods and tax requirements.

Automobile and 179 limits can be input to stay current with changing tax regulations.

Calculates Luxury Automobile Depreciation...

|

|

| Depreciation Solution is an extremely easy way to calculate Federal and book depreciation. All depreciation and amortization methods required for federal tax reporting are included in an easy to use calculator format. Extensive on line help details methods and tax requirements.New maximum automobile amounts can be input to stay current with changing tax regulations. A formal depreciation schedule can be printed. Half-year, mid-quarter, and mid-month convention are provided. Depreciation is generated using IRS tax tables.This is an ideal application for a CPA, or anyone doing tax schedule 4562, justify capital purchases, or manually booking depreciation.The following depreciation methods are supported: ADS Amortization MACRS - 200 DB MACRS - 150 DB MACRS - Straight-Line Straight -Line .. |

|

| Depreciation 4562 is an extremely efficient way to calculate Federal Tax Depreciation. Form 4562 is computed with a minimum amount of input. This is an idea tool for a tax professional, CPA, or anyone needing to complete tax depreciation. Asset data information is retained in a database for use in preparing future tax returns. An unlimited number of Companies or Clients can be maintained. Depreciation 4562 was created for the tax preparer that needs to do federal tax reporting, but does not need the expense and complexity that most depreciation application have.

All depreciation and amortization methods required for federal tax reporting is included in an easy to use format. Extensive On-Line Help details methods and tax requirements.

Some of the features of Depreciation 4562

Computes and prints Form 4562.

Calculates Luxury Automobile Depreciation.

Tracks Section 179 deductions and limits.

Determines the 30 or 50 percent Special Depreciation Bonus.

Checks to see if mid quarter convention is required.

Nine comprehensive reports are provided.

Easy customization of asset classes simplifies asset input.

New maximum automobile amounts can be input to stay current with changing tax regulations. A formal depreciation schedule can be printed. Half-year, mid-quarter, and mid-month conventions are provided. Depreciation is generated using IRS tax tables.

The following depreciation methods are supported

ADS

Amortization

MACRS - 200 DB

MACRS - 150 DB

MACRS - Straight-Line

Straight - Line.. |

|

| Asset Register PRO for Excel supplies nine asset registers plus YTD depreciation reports for fixed, intangible and investment assets, updating and reporting depreciation calculations and book values at each month end. Each asset entered into the register can contain the asset sequence number, date of purchase, description of asset, serial number, supplier's name, purchase order number, G/L reference code, accounting cost, useful life (depreciation period), physical location, plus if/when disposed/sold and gain/loss calculations and impairment ledgers for investments, intangibles and goodwill. Asset Register PRO can be used by the smallest to the largest enterprise to keep track of their assets and monthly depreciation calculations. Asset Register PRO applies the straight-line depreciation method, and the declining balance method adjusted annually and monthly. Depreciation tables supply monthly depreciation and cumulative depreciation from the acquired date to any period up to 240 months.

Quick and easy entry of assets into the registers using Excel's Data (Entry) > Form with the Name box.

Asset Register PRO provides continuous month end sequencing so that the asset class registers update each asset depreciation and book value every month automatically and combines all month end values into a Year To Date and Totals report. Different depreciation periods can be applied to individual assets and within each class of assets.

Asset Register PRO calculates book values at disposal dates and gain/losses on disposal.

All month end depreciation calculations and book balances can be recalculated backwards and forwards to any month end date by making a simple one step adjustment to the month end date held in the adate field. You can recalculate and forecast depreciation totals and written down balances for any month end past or future. Such calculations can be very useful for preparing financial business forecasts and for checking depreciation calculations... |

|

| Asset Register PRO for Excel supplies nine asset registers plus YTD depreciation reports for fixed, intangible and investment assets, updating and reporting depreciation calculations and book values at each month end. Each asset entered into the register can contain the asset sequence number, date of purchase, description of asset, serial number, supplier's name, purchase order number, G/L reference code, accounting cost, useful life (depreciation period), physical location, plus if/when disposed/sold and gain/loss calculations and impairment ledgers for investments, intangibles and goodwill. Asset Register PRO can be used by the smallest to the largest enterprise to keep track of their assets and monthly depreciation calculations. Asset Register PRO applies the straight-line depreciation method, and the declining balance method adjusted annually and monthly. Depreciation tables supply monthly depreciation and cumulative depreciation from the acquired date to any period up to 240 months.

Quick and easy entry of assets into the registers using Excel's Data (Entry) > Form with the Name box.

Asset Register PRO provides continuous month end sequencing so that the asset class registers update each asset depreciation and book value every month automatically and combines all month end values into a Year To Date and Totals report. Different depreciation periods can be applied to individual assets and within each class of assets.

Asset Register PRO calculates book values at disposal dates and gain/losses on disposal.

All month end depreciation calculations and book balances can be recalculated backwards and forwards to any month end date by making a simple one step adjustment to the month end date held in the adate field. You can recalculate and forecast depreciation totals and written down balances for any month end past or future. Such calculations can be very useful for preparing financial business forecasts and for checking depreciation calculations... |

|

Results in Description For depreciation

| Depreciation 4562 is an extremely efficient way to calculate Federal Tax Depreciation. Form 4562 is computed with a minimum amount of input. This is an idea tool for a tax professional, CPA, or anyone needing to complete tax depreciation. Asset data information is retained in a database for use in preparing future tax returns. An unlimited number of Companies or Clients can be maintained. Depreciation 4562 was created for the tax preparer that needs to do federal tax reporting, but does not need the expense and complexity that most depreciation application have.

All depreciation and amortization methods required for federal tax reporting is included in an easy to use format. Extensive On-Line Help details methods and tax requirements.

Some of the features of Depreciation 4562

Computes and prints Form 4562.

Calculates Luxury Automobile Depreciation.

Tracks Section 179 deductions and limits.

Determines the 30 or 50 percent Special Depreciation Bonus.

Checks to see if mid quarter convention is required.

Nine comprehensive reports are provided.

Easy customization of asset classes simplifies asset input.

New maximum automobile amounts can be input to stay current with changing tax regulations. A formal depreciation schedule can be printed. Half-year, mid-quarter, and mid-month conventions are provided. Depreciation is generated using IRS tax tables.

The following depreciation methods are supported

ADS

Amortization

MACRS - 200 DB

MACRS - 150 DB

MACRS - Straight-Line

Straight - Line.. |

|

| AcQuest HQ Depreciation. Windows XP, Vista, & Windows 7. Fed. and GAAP depreciation. With shareware version, open years cannot be rolled forward. Supports most deprecation methods...

|

|

| AcQuest Pro Depreciation. Windows XP, Vista. & Windows 7. Fed, GAAP, state, AMT, and ACE depreciation for multiple companies. With demo years cannot be rolled forward. Supports most deprecation methods... |

|

| Asset Register PRO for Excel supplies nine asset registers plus YTD depreciation reports for fixed, intangible and investment assets, updating and reporting depreciation calculations and book values at each month end. Each asset entered into the register can contain the asset sequence number, date of purchase, description of asset, serial number, supplier's name, purchase order number, G/L reference code, accounting cost, useful life (depreciation period), physical location, plus if/when disposed/sold and gain/loss calculations and impairment ledgers for investments, intangibles and goodwill. Asset Register PRO can be used by the smallest to the largest enterprise to keep track of their assets and monthly depreciation calculations. Asset Register PRO applies the straight-line depreciation method, and the declining balance method adjusted annually and monthly. Depreciation tables supply monthly depreciation and cumulative depreciation from the acquired date to any period up to 240 months.

Quick and easy entry of assets into the registers using Excel's Data (Entry) > Form with the Name box.

Asset Register PRO provides continuous month end sequencing so that the asset class registers update each asset depreciation and book value every month automatically and combines all month end values into a Year To Date and Totals report. Different depreciation periods can be applied to individual assets and within each class of assets.

Asset Register PRO calculates book values at disposal dates and gain/losses on disposal.

All month end depreciation calculations and book balances can be recalculated backwards and forwards to any month end date by making a simple one step adjustment to the month end date held in the adate field. You can recalculate and forecast depreciation totals and written down balances for any month end past or future. Such calculations can be very useful for preparing financial business forecasts and for checking depreciation calculations...

|

|

| Asset Register PRO for Excel supplies nine asset registers plus YTD depreciation reports for fixed, intangible and investment assets, updating and reporting depreciation calculations and book values at each month end. Each asset entered into the register can contain the asset sequence number, date of purchase, description of asset, serial number, supplier's name, purchase order number, G/L reference code, accounting cost, useful life (depreciation period), physical location, plus if/when disposed/sold and gain/loss calculations and impairment ledgers for investments, intangibles and goodwill. Asset Register PRO can be used by the smallest to the largest enterprise to keep track of their assets and monthly depreciation calculations. Asset Register PRO applies the straight-line depreciation method, and the declining balance method adjusted annually and monthly. Depreciation tables supply monthly depreciation and cumulative depreciation from the acquired date to any period up to 240 months.

Quick and easy entry of assets into the registers using Excel's Data (Entry) > Form with the Name box.

Asset Register PRO provides continuous month end sequencing so that the asset class registers update each asset depreciation and book value every month automatically and combines all month end values into a Year To Date and Totals report. Different depreciation periods can be applied to individual assets and within each class of assets.

Asset Register PRO calculates book values at disposal dates and gain/losses on disposal.

All month end depreciation calculations and book balances can be recalculated backwards and forwards to any month end date by making a simple one step adjustment to the month end date held in the adate field. You can recalculate and forecast depreciation totals and written down balances for any month end past or future. Such calculations can be very useful for preparing financial business forecasts and for checking depreciation calculations... |

|

| Asset Register PRO for Excel supplies nine asset registers plus YTD depreciation reports for fixed, intangible and investment assets, updating and reporting depreciation calculations and book values at each month end. Each asset entered into the register can contain the asset sequence number, date of purchase, description of asset, serial number, supplier's name, purchase order number, G/L reference code, accounting cost, useful life (depreciation period), physical location, plus if/when disposed/sold and gain/loss calculations and impairment ledgers for investments, intangibles and goodwill. Asset Register PRO can be used by the smallest to the largest enterprise to keep track of their assets and monthly depreciation calculations. Asset Register PRO applies the straight-line depreciation method, and the declining balance method adjusted annually and monthly. Depreciation tables supply monthly depreciation and cumulative depreciation from the acquired date to any period up to 240 months.

Quick and easy entry of assets into the registers using Excel's Data (Entry) > Form with the Name box.

Asset Register PRO provides continuous month end sequencing so that the asset class registers update each asset depreciation and book value every month automatically and combines all month end values into a Year To Date and Totals report. Different depreciation periods can be applied to individual assets and within each class of assets.

Asset Register PRO calculates book values at disposal dates and gain/losses on disposal.

All month end depreciation calculations and book balances can be recalculated backwards and forwards to any month end date by making a simple one step adjustment to the month end date held in the adate field. You can recalculate and forecast depreciation totals and written down balances for any month end past or future. Such calculations can be very useful for preparing financial business forecasts and for checking depreciation calculations...

|

|

| Depreciation 4562 Pro is a complete fixed asset system which includes book and tax depreciation, management reporting, and asset tracking. Current tax rules for depreciation are built in, to guide you through the process of adding assets to meet federal requirements. All depreciation and amortization methods required for federal tax reporting is included in an easy to use format. Extensive on-line help details methods and tax requirements. This cost-effective software was designed to meet your business needs. You can create an unlimited number of companies and assets. Fixed Assets can be classified by asset type, class, general ledger account, or location. Detail information is tracked by asset. There are twelve standard reports, which can be preview or printed. Some of the features of Depreciation 4562 Pro Easy customization of asset classes simplifies asset input. Most reports can be produced for any period, historical or future. Supports fiscal years ending in any calendar month. Keeps track of Tax and Book depreciation. Multiple users are supported Unlimited FREE technical support is included. Supports an unlimited number of companies and assets. A Sample Company and data are included to reduce the learning curve. Auto calculation of accumulated depreciation to aid in conversion of assets from a different application. Depreciation is generated using IRS tax tables. Eight comprehensive tax reports are provided. Five standard Book reports are included. Produces monthly journal entry for book depreciation. New maximum automobile limits can be input to stay current with changing tax regulations. Backup Wizard makes it easy to backup valuable fixed asset data. Keeps track of assets by location. Maintains notes on each asset. A formal depreciation schedule can be printed. Compliant with all federal tax requirements... |

|

| Use AssetManage Enterprise to track where your assets are, what state they are in, and who they are currently assigned to. Scan and print barcode labels directly from the program. Generate Monthly & Annual Depreciation schedules for each asset... |

|

| Prophesy PIM lets you store detailed information about all of your personal items: purchase price, vendor, digital photos etc., and calculates current value via a variety of depreciation methods. It.. |

|

| Use AssetManage to track where your assets are, what state they are in, and who they are currently assigned to. Easily print your own asset tags. Generate Monthly & Annual Depreciation schedules for each asset... |

|

Results in Tags For depreciation

| Depreciation 4562 is an extremely efficient way to calculate Federal Tax Depreciation. Form 4562 is computed with a minimum amount of input. This is an idea tool for a tax professional, CPA, or anyone needing to complete tax depreciation. Asset data information is retained in a database for use in preparing future tax returns. An unlimited number of Companies or Clients can be maintained. Depreciation 4562 was created for the tax preparer that needs to do federal tax reporting, but does not need the expense and complexity that most depreciation application have.

All depreciation and amortization methods required for federal tax reporting is included in an easy to use format. Extensive On-Line Help details methods and tax requirements.

Some of the features of Depreciation 4562

Computes and prints Form 4562.

Calculates Luxury Automobile Depreciation.

Tracks Section 179 deductions and limits.

Determines the 30 or 50 percent Special Depreciation Bonus.

Checks to see if mid quarter convention is required.

Nine comprehensive reports are provided.

Easy customization of asset classes simplifies asset input.

New maximum automobile amounts can be input to stay current with changing tax regulations. A formal depreciation schedule can be printed. Half-year, mid-quarter, and mid-month conventions are provided. Depreciation is generated using IRS tax tables.

The following depreciation methods are supported

ADS

Amortization

MACRS - 200 DB

MACRS - 150 DB

MACRS - Straight-Line

Straight - Line.. |

|

| Asset Register PRO for Excel supplies nine asset registers plus YTD depreciation reports for fixed, intangible and investment assets, updating and reporting depreciation calculations and book values at each month end. Each asset entered into the register can contain the asset sequence number, date of purchase, description of asset, serial number, supplier's name, purchase order number, G/L reference code, accounting cost, useful life (depreciation period), physical location, plus if/when disposed/sold and gain/loss calculations and impairment ledgers for investments, intangibles and goodwill. Asset Register PRO can be used by the smallest to the largest enterprise to keep track of their assets and monthly depreciation calculations. Asset Register PRO applies the straight-line depreciation method, and the declining balance method adjusted annually and monthly. Depreciation tables supply monthly depreciation and cumulative depreciation from the acquired date to any period up to 240 months.

Quick and easy entry of assets into the registers using Excel's Data (Entry) > Form with the Name box.

Asset Register PRO provides continuous month end sequencing so that the asset class registers update each asset depreciation and book value every month automatically and combines all month end values into a Year To Date and Totals report. Different depreciation periods can be applied to individual assets and within each class of assets.

Asset Register PRO calculates book values at disposal dates and gain/losses on disposal.

All month end depreciation calculations and book balances can be recalculated backwards and forwards to any month end date by making a simple one step adjustment to the month end date held in the adate field. You can recalculate and forecast depreciation totals and written down balances for any month end past or future. Such calculations can be very useful for preparing financial business forecasts and for checking depreciation calculations...

|

|

| Depreciation 4562 Pro is a complete fixed asset system which includes book and tax depreciation, management reporting, and asset tracking. Current tax rules for depreciation are built in, to guide you through the process of adding assets to meet federal requirements. All depreciation and amortization methods required for federal tax reporting is included in an easy to use format. Extensive on-line help details methods and tax requirements. This cost-effective software was designed to meet your business needs. You can create an unlimited number of companies and assets. Fixed Assets can be classified by asset type, class, general ledger account, or location. Detail information is tracked by asset. There are twelve standard reports, which can be preview or printed. Some of the features of Depreciation 4562 Pro Easy customization of asset classes simplifies asset input. Most reports can be produced for any period, historical or future. Supports fiscal years ending in any calendar month. Keeps track of Tax and Book depreciation. Multiple users are supported Unlimited FREE technical support is included. Supports an unlimited number of companies and assets. A Sample Company and data are included to reduce the learning curve. Auto calculation of accumulated depreciation to aid in conversion of assets from a different application. Depreciation is generated using IRS tax tables. Eight comprehensive tax reports are provided. Five standard Book reports are included. Produces monthly journal entry for book depreciation. New maximum automobile limits can be input to stay current with changing tax regulations. Backup Wizard makes it easy to backup valuable fixed asset data. Keeps track of assets by location. Maintains notes on each asset. A formal depreciation schedule can be printed. Compliant with all federal tax requirements... |

|

| AcQuest Pro Depreciation. Windows XP, Vista. & Windows 7. Fed, GAAP, state, AMT, and ACE depreciation for multiple companies. With demo years cannot be rolled forward. Supports most deprecation methods...

|

|

| Depreciation Solution is an extremely easy way to calculate Federal and book depreciation. All depreciation and amortization methods required for federal tax reporting are included in an easy to use calculator format. Extensive on line help details methods and tax requirements.New maximum automobile amounts can be input to stay current with changing tax regulations. A formal depreciation schedule can be printed. Half-year, mid-quarter, and mid-month convention are provided. Depreciation is generated using IRS tax tables.This is an ideal application for a CPA, or anyone doing tax schedule 4562, justify capital purchases, or manually booking depreciation.The following depreciation methods are supported: ADS Amortization MACRS - 200 DB MACRS - 150 DB MACRS - Straight-Line Straight -Line .. |

|

| Asset Register PRO for Excel supplies nine asset registers plus YTD depreciation reports for fixed, intangible and investment assets, updating and reporting depreciation calculations and book values at each month end. Each asset entered into the register can contain the asset sequence number, date of purchase, description of asset, serial number, supplier's name, purchase order number, G/L reference code, accounting cost, useful life (depreciation period), physical location, plus if/when disposed/sold and gain/loss calculations and impairment ledgers for investments, intangibles and goodwill. Asset Register PRO can be used by the smallest to the largest enterprise to keep track of their assets and monthly depreciation calculations. Asset Register PRO applies the straight-line depreciation method, and the declining balance method adjusted annually and monthly. Depreciation tables supply monthly depreciation and cumulative depreciation from the acquired date to any period up to 240 months.

Quick and easy entry of assets into the registers using Excel's Data (Entry) > Form with the Name box.

Asset Register PRO provides continuous month end sequencing so that the asset class registers update each asset depreciation and book value every month automatically and combines all month end values into a Year To Date and Totals report. Different depreciation periods can be applied to individual assets and within each class of assets.

Asset Register PRO calculates book values at disposal dates and gain/losses on disposal.

All month end depreciation calculations and book balances can be recalculated backwards and forwards to any month end date by making a simple one step adjustment to the month end date held in the adate field. You can recalculate and forecast depreciation totals and written down balances for any month end past or future. Such calculations can be very useful for preparing financial business forecasts and for checking depreciation calculations...

|

|

| Depreciation 4562 Pro is a complete fixed asset system which includes book and tax depreciation, management reporting, and asset tracking. Current tax rules for depreciation are built in, to guide you through the process of adding assets to meet federal r.. |

|

| Asset Register PRO for Excel supplies nine asset registers plus YTD depreciation reports for fixed, intangible and investment assets, updating and reporting depreciation calculations and book values at each month end. Each asset entered into the register can contain the asset sequence number, date of purchase, description of asset, serial number, supplier's name, purchase order number, G/L reference code, accounting cost, useful life (depreciation period), physical location, plus if/when disposed/sold and gain/loss calculations and impairment ledgers for investments, intangibles and goodwill. Asset Register PRO can be used by the smallest to the largest enterprise to keep track of their assets and monthly depreciation calculations. Asset Register PRO applies the straight-line depreciation method, and the declining balance method adjusted annually and monthly. Depreciation tables supply monthly depreciation and cumulative depreciation from the acquired date to any period up to 240 months.

Quick and easy entry of assets into the registers using Excel's Data (Entry) > Form with the Name box.

Asset Register PRO provides continuous month end sequencing so that the asset class registers update each asset depreciation and book value every month automatically and combines all month end values into a Year To Date and Totals report. Different depreciation periods can be applied to individual assets and within each class of assets.

Asset Register PRO calculates book values at disposal dates and gain/losses on disposal.

All month end depreciation calculations and book balances can be recalculated backwards and forwards to any month end date by making a simple one step adjustment to the month end date held in the adate field. You can recalculate and forecast depreciation totals and written down balances for any month end past or future. Such calculations can be very useful for preparing financial business forecasts and for checking depreciation calculations... |

|

| Depreciation 4562 is an extremely efficient way to calculate Federal Tax Depreciation. Form 4562 is computed with a minimum amount of input. This is an idea tool for a tax professional, CPA, or anyone needing to complete tax depreciation. Asset data inf.. |

|

| SuperPro Asset Depreciation can save hundreds of dollars on accounting fees. Insures that you are maximizing you depreciation benefits. Reports include a depreciation detail and summary report and a year beginning and ending report. The progam will prduce your IRS forms #4562, Part 11 for current year and Part 111 for prior years and the IRS #4797, Part 1, Sale of Property form. Provides an easily readable detail screen for each asset and show the total depreciation for each. This program requires some knowledge of IRS income tax and depreciatioin .. |

|

Related search : onth endregister proasset registerdepreciation calculationsmonthly depreciationasset depreciationcalculations and,asset depreciation tool4562 prodepreciation 4562,pro depreciation 4562pro depreciationacquest pro,depreciation solution,download depreciOrder by Related

- New Release

- Rate

depreciation schedules -

depreciation methods -

depreciation calculation -

bonus depreciation -

depreciation software -

|

|