|

|

TAG: depreciation, macrs, methods, input, federal, asset, , depreciation 4562, federal tax, 4562 depreciation 4562, depreciation 4562 depreciation, Best Search Category: mortgage, debt consolidation, poker, credit card, loan, online poker, insurance soft, background check, lottery, credit soft, ringtone, employment, satellite, wireless, finance

License / Price:

Shareware / 59.00 $

|

Category :

Business

/ Personal Finance

|

Requirements :

|

Publisher / Limitations:

Microtechware / |

Size / Last Updated:

3527KB / 2008-03-21 |

TAG: depreciation, macrs, methods, input, federal, asset, ,

depreciation, federal tax, depreciation, depreciation depreciation,

|

Operating System:

Win95, Win98, WinME, WinNT 3.x, WinNT 4.x, Windows2000, WinXP, Windows2003 |

Download:

Download

|

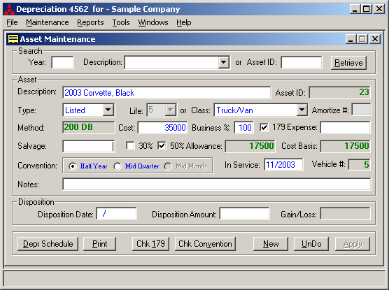

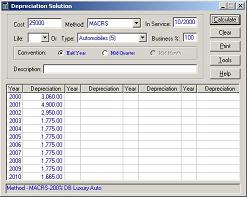

Publisher's description - Depreciation 4562

Depreciation 4562 is an extremely efficient way to calculate Federal Tax Depreciation. Form 4562 is computed with a minimum amount of input. This is an idea tool for a tax professional, CPA, or anyone needing to complete tax depreciation. Asset data information is retained in a database for use in preparing future tax returns. An unlimited number of Companies or Clients can be maintained. Depreciation 4562 was created for the tax preparer that needs to do federal tax reporting, but does not need the expense and complexity that most depreciation application have.

All depreciation and amortization methods required for federal tax reporting is included in an easy to use format. Extensive On-Line Help details methods and tax requirements.

Some of the features of Depreciation 4562

Computes and prints Form 4562.

Calculates Luxury Automobile Depreciation.

Tracks Section 179 deductions and limits.

Determines the 30 or 50 percent Special Depreciation Bonus.

Checks to see if mid quarter convention is required.

Nine comprehensive reports are provided.

Easy customization of asset classes simplifies asset input.

New maximum automobile amounts can be input to stay current with changing tax regulations. A formal depreciation schedule can be printed. Half-year, mid-quarter, and mid-month conventions are provided. Depreciation is generated using IRS tax tables.

The following depreciation methods are supported

ADS

Amortization

MACRS - 200 DB

MACRS - 150 DB

MACRS - Straight-Line

Straight - Line

|

Related app - Depreciation 4562

|

Also see ...

...in Business  1)

Refrigerant Compliance Manager

1)

Refrigerant Compliance Manager

Refrigerant Regulations Management System helps you comply with EPA regulations on ozone depleting and global warming refrigerants. Use RCM 2000 to effectively implement regulatory requirements, insure ongoing compliance of employees and subcontractors, achieve uniform and consistent documentation and record-keeping, and control your valuable refrigerant inventory. Reduce administration costs and the risk of errors. Create required reports....

2)

Spread permission email marketing

2)

Spread permission email marketing

Web-based DIY permission email marketing and newsletter management system ; No Spam, No Download, No Install. Free Trial...

|

...in Personal Finance  1)

Ideaspad

1)

Ideaspad

Ideaspad helps you to organize / manage your notes, information, documents, as easy to use as card file rolodex. Manipulate your information by moving, coping topics and sub topics branches to suit your needs. All the basic word processor features including spell checker and rich text (RTF) capabilities e.g. Fonts, search / replace, bullets and all the text formatting you expect in a word processing package. Create bookmarks and assign icons to your topics, you can even search for topics by an i...

2)

VisualStore

2)

VisualStore

VisualStore is an organizer to organize your notes, URLs, images, email addresses and etc. To organize some sort of information, VisualStore lets you build a custom list. A List in VisualStore is a table that you define the fields of it.Some of the other features are including, Tree structure, HTML export, and easy to use interface. VisualStore is a utility for all those who want to keep themself quite organize....

|

|

Related tags:

|

|