|

|

Order by Related

- New Release

- Rate

Results in Title For stochastic

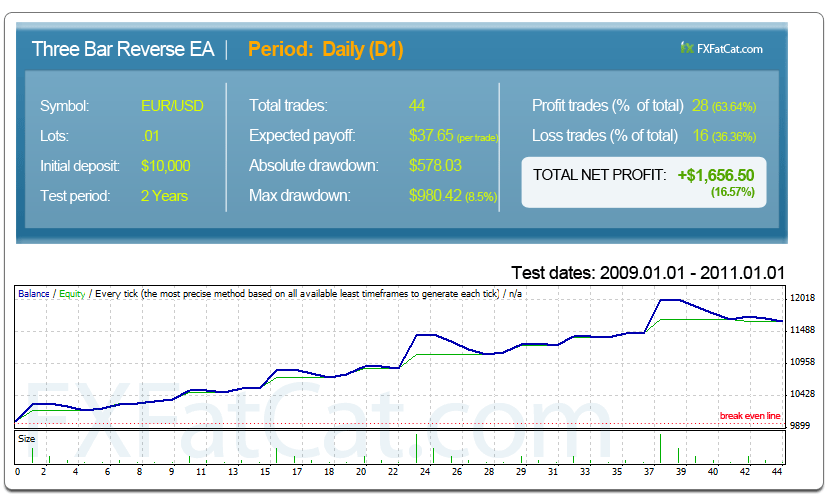

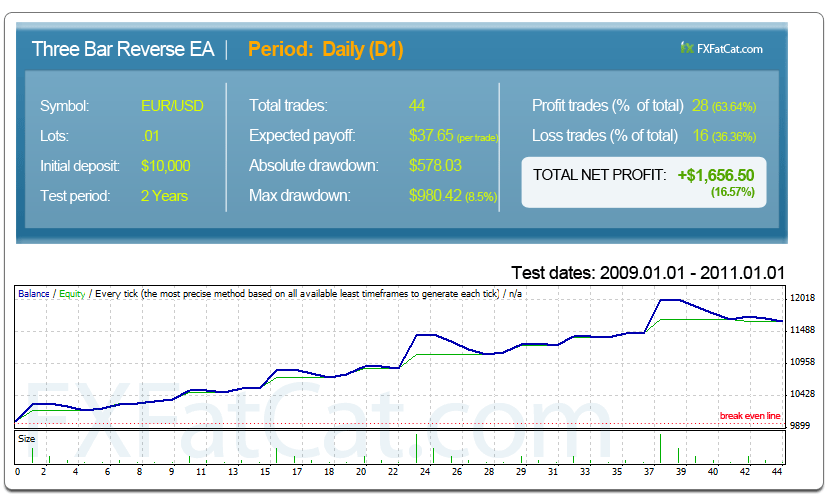

| Free Expert Advisor 3-Stochastic. Fully automated trading system - Metatrader Expert Advisor. .. |

|

| Warning - This is a martinale EA. It can and probably will blow up an account. Use only on a demo account for entertainment and education. Do not use on a live account. ..

|

|

Results in Keywords For stochastic

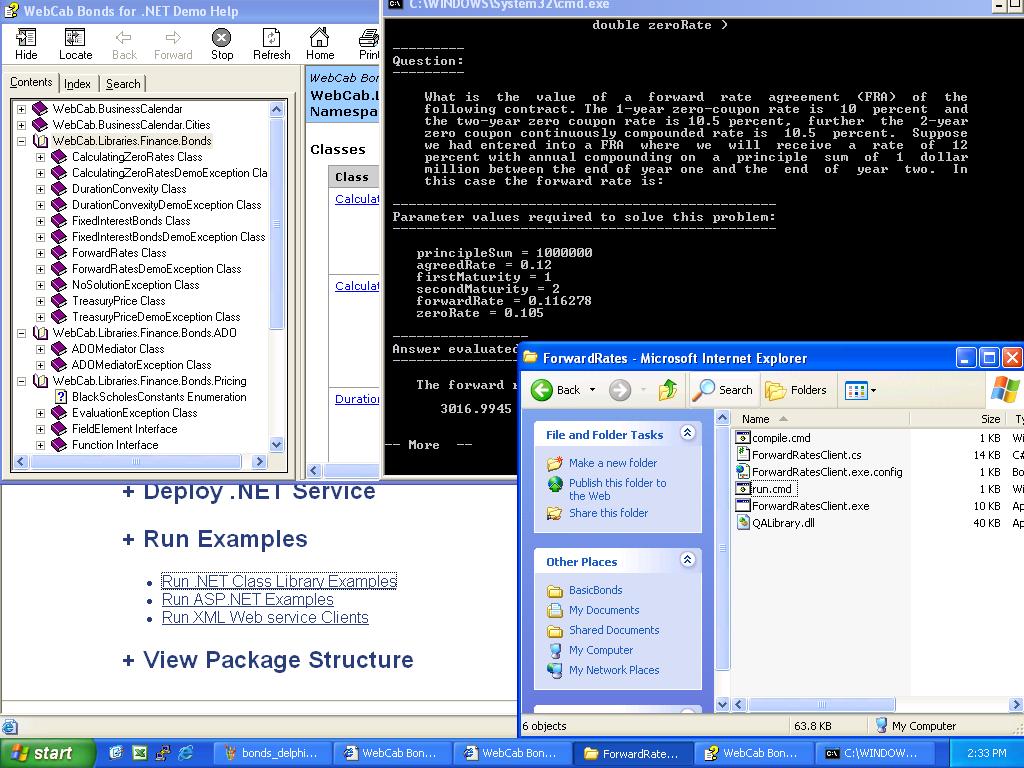

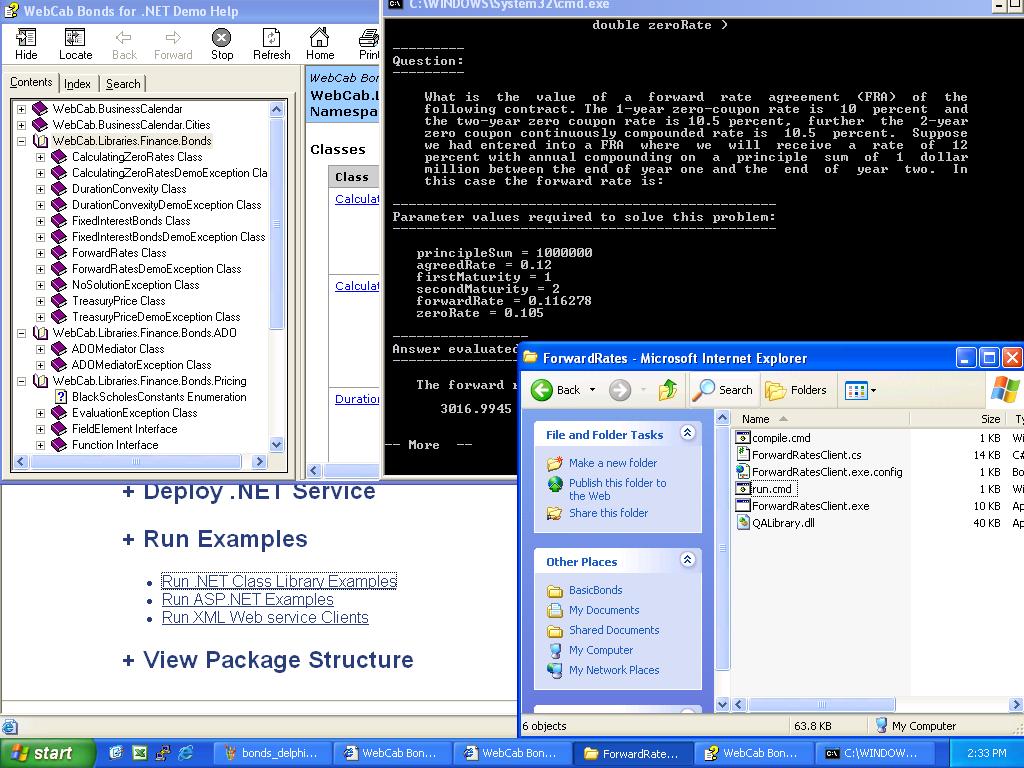

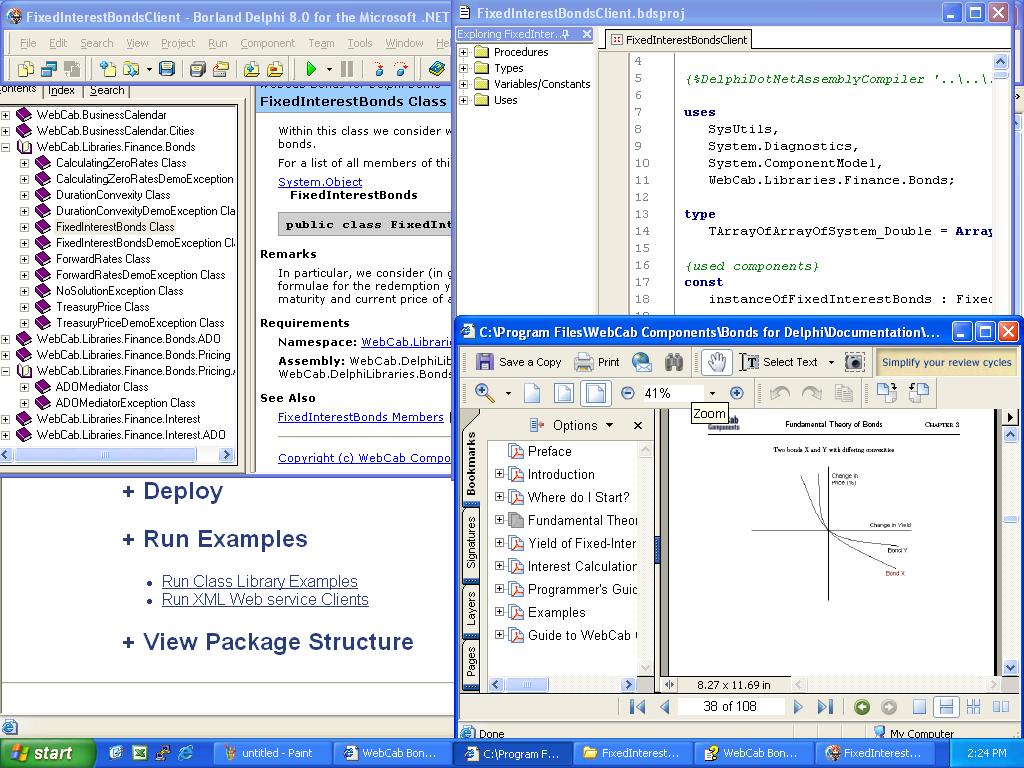

| 3-in-1: COM, .NET and XML Web service Interest derivatives pricing framework: set contract, set vol/price/interest models and run MC. We also cover: Treasury bonds, Price/Yield, Zero Curve, Fixed-Interest bonds, Forward rates/FRAs, Duration and Convexity.

General Pricing Framework offers the following predefined Models and Contracts:

Contracts: Asian Option, Binary Option, Cap, Coupon Bond, Floor, Forward Start stock option, Lookback Option, Ladder Option, Vanilla Swap, Vanilla Stock Option, Zero Coupon Bond, Barrier Option, Parisian Option, Parasian Option, Forward and Future.

Interest Rate Models: Constant Spot Rate, Constant (in time) Yield curve, One factor stochastic models (Vasicek, Black-Derman-Toy (BDT), Ho & Lee, Hull and White), Two factor stochastic models (Breman & Schwartz, Fong & Vasicek, Longstaff & Schwartz), Cox-Ingersoll-Ross Equilibrium model, Spot rate model with automatic yield (Ho & Lee, Hull & White), Heath-Jarrow-Morton forward rate model, Brace-Gatarek-Musiela (BGM) LIBOR market model.

Price Models: Constant price model, General deterministic price model, Lognormal price model, Poisson price model.

Volatility Models: Constant Volatility Models, General Deterministic Volatility model, Hull & White Stochastic model of the Variance, Hoston Stochastic Volatility model.

Monte Carlo Princing Engine: Evaluate price estimate accordance to number of iterations or maximum expected error. Evaluate the standard deviation of the price estimate, and the minimum/maximum expected price for a given confidence level.

This product also has the following technology aspects:

3-in-1: .NET, COM, and XML Web services - 3 DLLs, 3 API Docs,...

Extensive Client Examples (C#, VB, C++,...)

ADO Mediator

Compatible Containers (VS 6, VS.NET, Office 97/2000/XP/2003, C++Builder, Delphi 3-2005).. |

|

| 3-in-1: COM, .NET and XML Web service Interest derivatives pricing framework: set contract, set vol/price/interest models and run MC. We also cover: Treasury's, Price/Yield, Zero Curve, Fixed-Interest bonds, Forward rates/FRAs, Duration and Convexity..

|

|

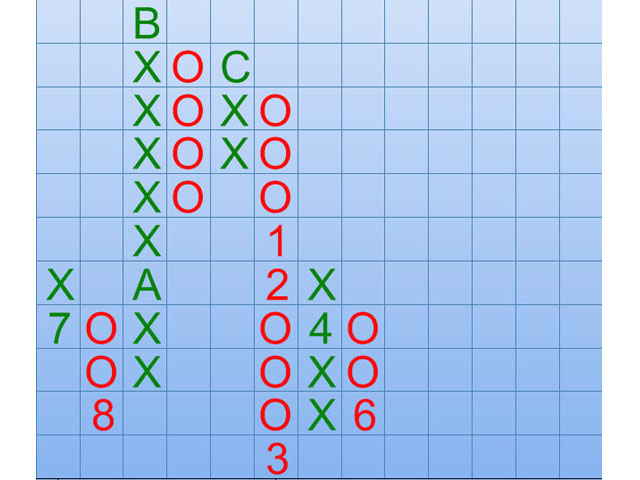

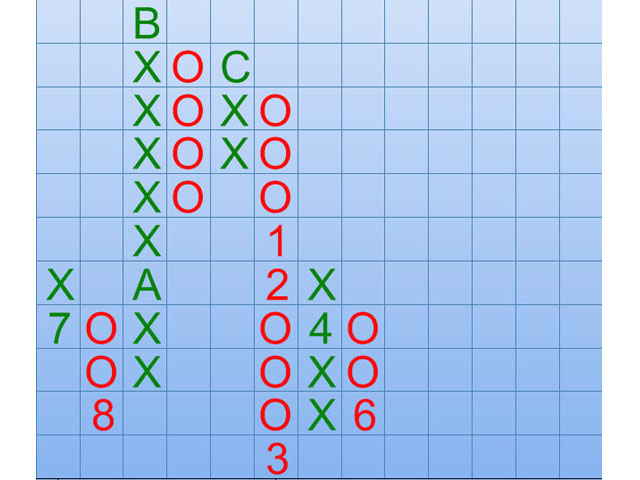

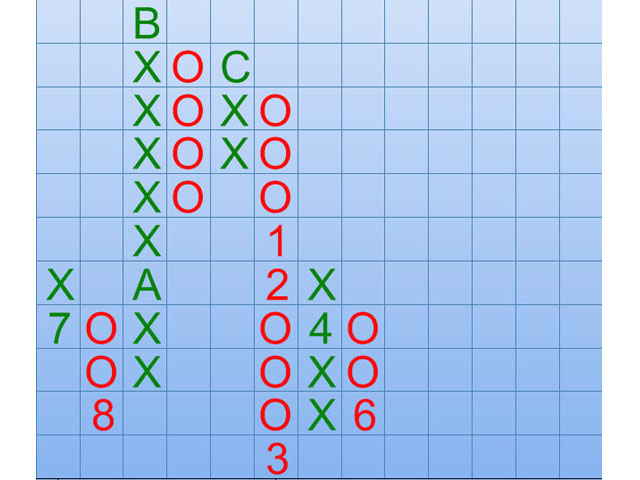

| Point & Figure Charts software is a stock analysis tool for individual investors and traders to identify buy-and-sell signals. The premier feature is Point & Figure Chart that is implemented with classic scale and custom scale. and much more... |

|

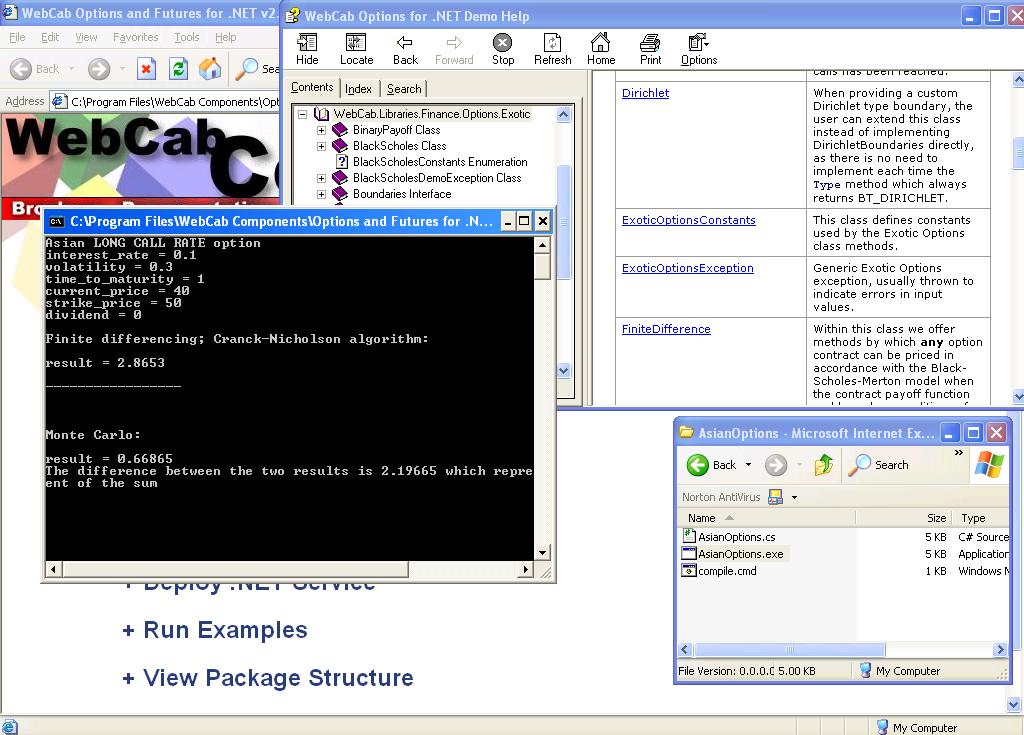

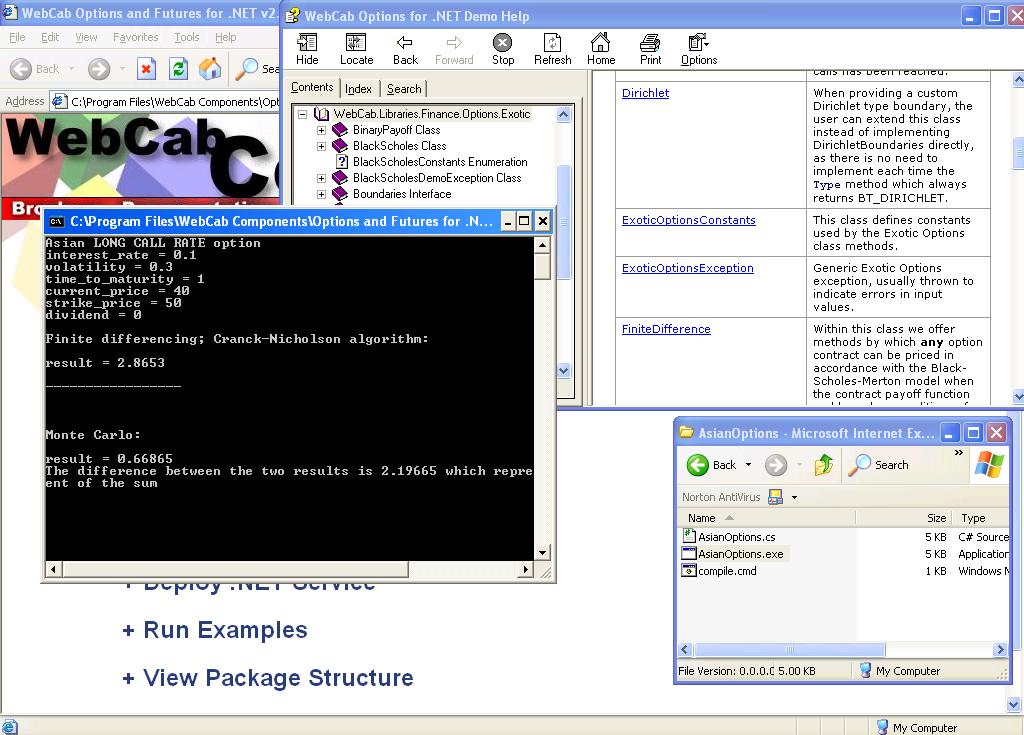

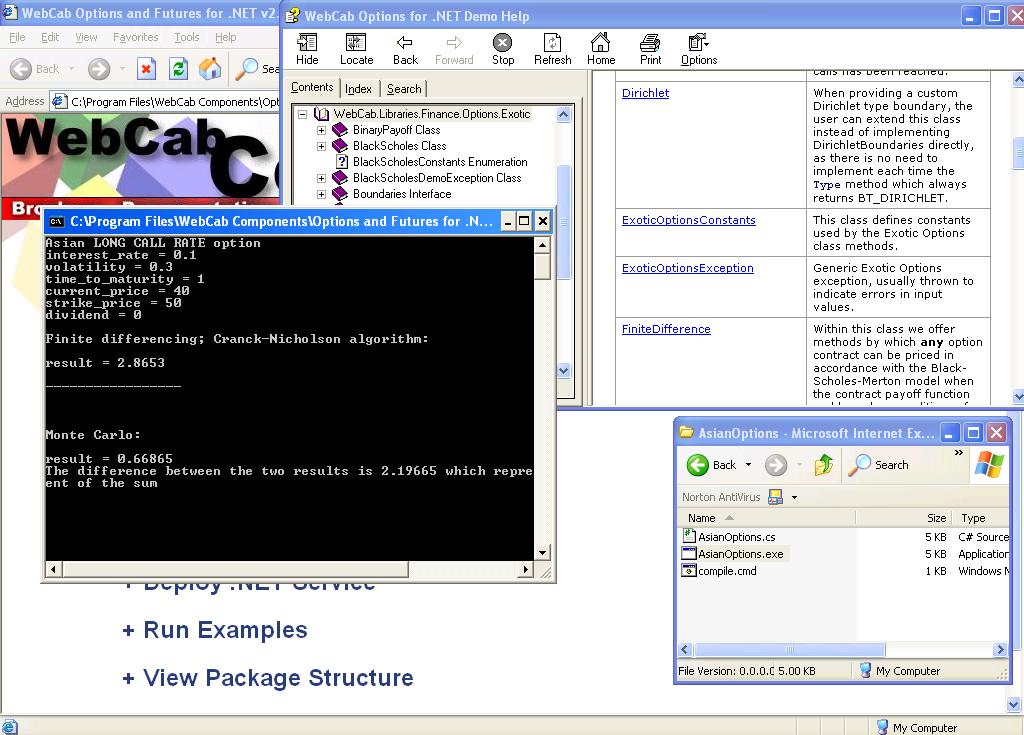

| 3-in-1: .NET, COM and XML Web service Components for pricing option and futures contracts using Monte Carlo and Finite Difference techniques. General MC pricing framework included: wide range of contracts, price, interest and vol models...

|

|

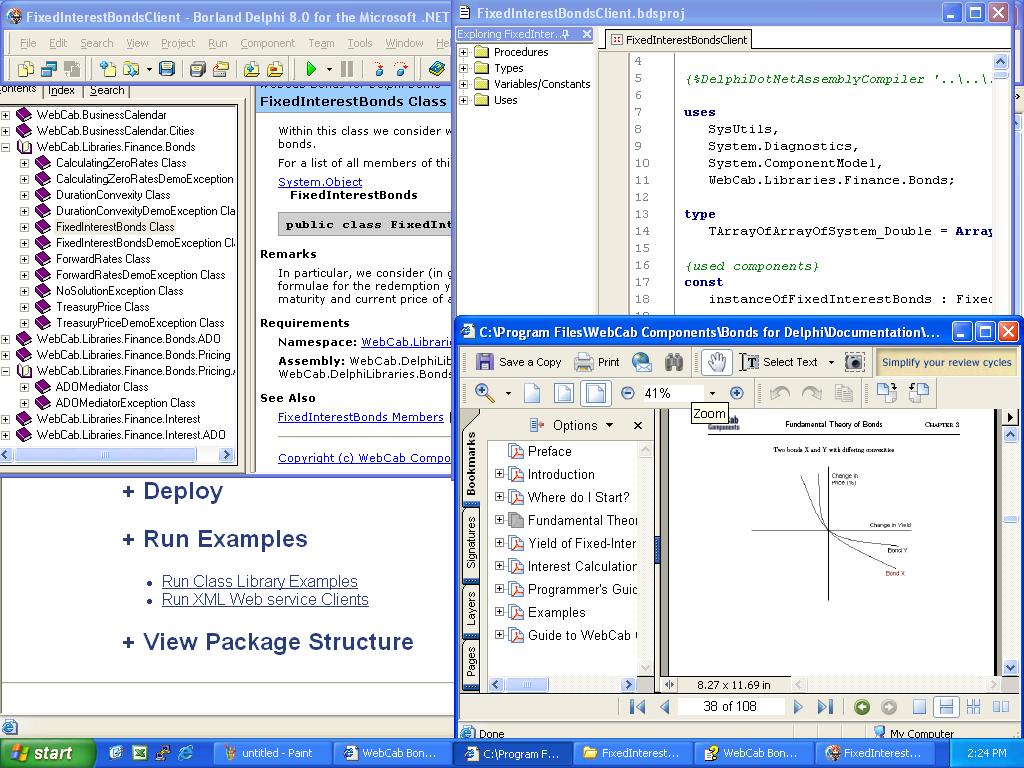

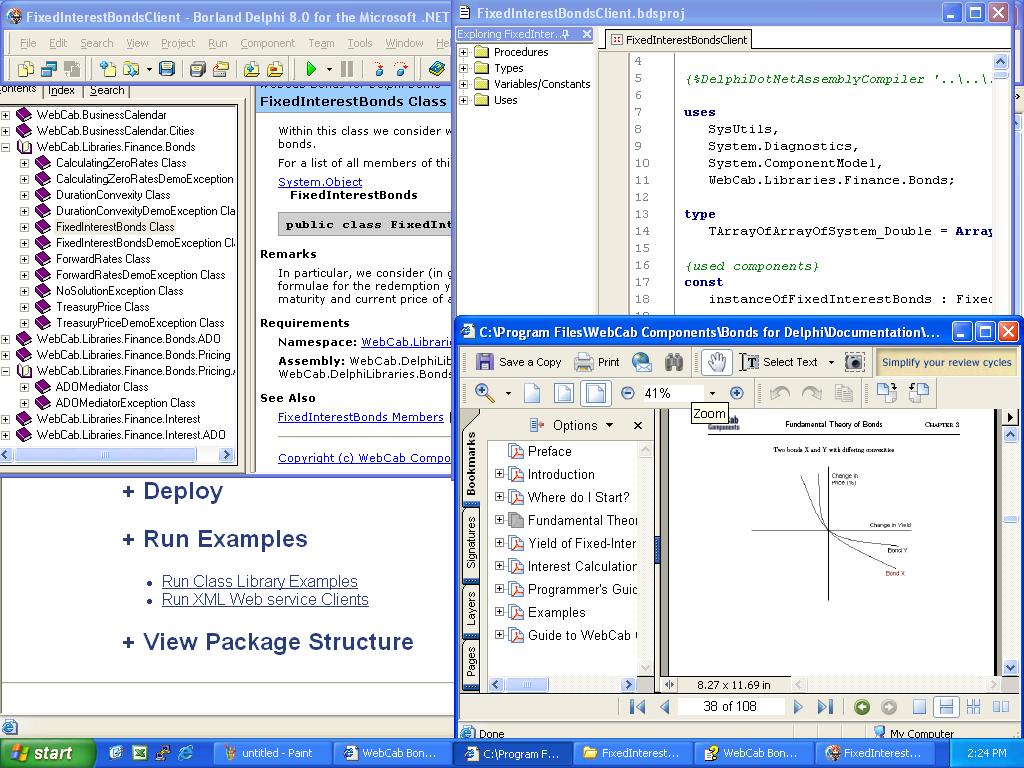

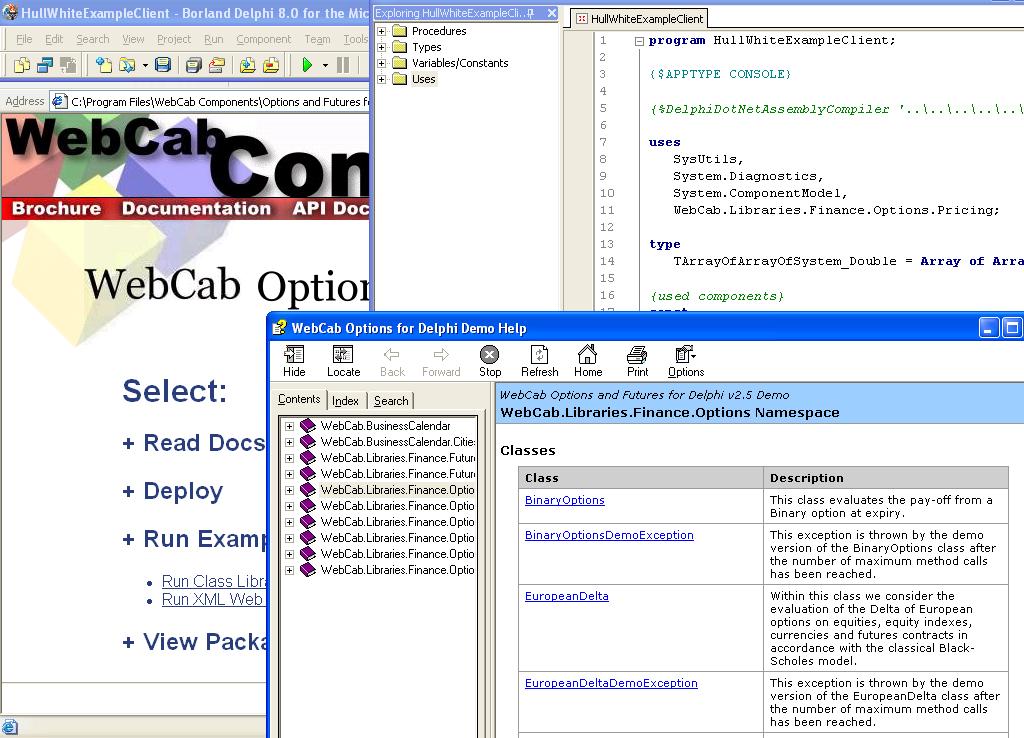

| 3-in-1: .NET, COM and XML Web service Components for pricing option and futures contracts using Monte Carlo and Finite Difference techniques. General Monte Carlo pricing framework: wide range of contracts, price, interest and vol models. Price European, Asian, American, Lookback, Bermuda and Binary Options using Analytic, Monte Carlo and Finite Difference in accordance with a number of vol, price, volatility and rate models.

General Pricing Framework offers the following predefined Models and Contracts:

Contracts: Asian Option, Binary Option, Cap, Coupon Bond, Floor, Forward Start stock option, Lookback Option, Ladder Option, Vanilla Swap, Vanilla Stock Option, Zero Coupon Bond, Barrier Option, Parisian Option, Parasian Option, Forward and Future.

Interest Rate Models: Constant Spot Rate, Constant (in time) Yield curve, One factor stochastic models (Vasicek, Black-Derman-Toy (BDT), Ho & Lee, Hull and White), Two factor stochastic models (Breman & Schwartz, Fong & Vasicek, Longstaff & Schwartz), Cox-Ingersoll-Ross Equilibrium model, Spot rate model with automatic yield (Ho & Lee, Hull & White), Heath-Jarrow-Morton forward rate model, Brace-Gatarek-Musiela (BGM) LIBOR market model.

Price Models: Constant price model, General deterministic price model, Lognormal price model, Poisson price model.

Volatility Models: Constant Volatility Models, General Deterministic Volatility model, Hull & White Stochastic model of the Variance, Hoston Stochastic Volatility model.

Monte Carlo Princing Engine: Evaluate price estimate accordance to number of iterations or maximum expected error. Evaluate the standard deviation of the price estimate, and the minimum/maximum expected price for a given confidence level.

This product also has the following technology aspects:

3-in-1: .NET, COM, and XML Web services - 3 DLLs, 3 API Docs,...

Extensive Client Examples (Delphi for .NET, C#, VB.NET)

ADO Mediator

Compatible Containers (Delphi 3-8, Delphi 2005, C++Builder.. |

|

Results in Description For stochastic

| This package provides Generalized Petri-Nets simulation, It gives the user the ability to construct and to simulate different types of Petri Net.Supported Petri-Nets types: Discrete Petri Net Autonomous Petri Net Non-Autonomous T-Timed and P-Timed Petri Net Stochastic Petri Net Continuous Petri Net CSPN (Constant Speed Petri Net) VSPN (Variable Speed Petri Net) Hybrid Petri-Net.. |

|

Results in Tags For stochastic

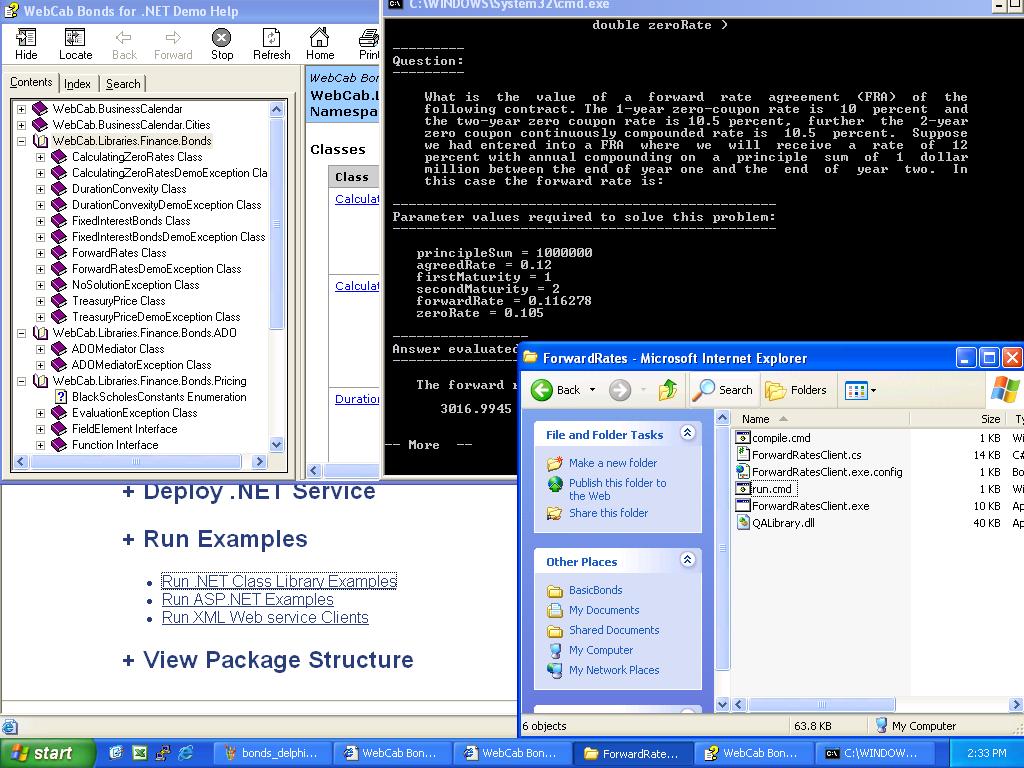

| 3-in-1: COM, .NET and XML Web service Interest derivatives pricing framework: set contract, set vol/price/interest models and run MC. We also cover: Treasury bonds, Price/Yield, Zero Curve, Fixed-Interest bonds, Forward rates/FRAs, Duration and Convexity.

General Pricing Framework offers the following predefined Models and Contracts:

Contracts: Asian Option, Binary Option, Cap, Coupon Bond, Floor, Forward Start stock option, Lookback Option, Ladder Option, Vanilla Swap, Vanilla Stock Option, Zero Coupon Bond, Barrier Option, Parisian Option, Parasian Option, Forward and Future.

Interest Rate Models: Constant Spot Rate, Constant (in time) Yield curve, One factor stochastic models (Vasicek, Black-Derman-Toy (BDT), Ho & Lee, Hull and White), Two factor stochastic models (Breman & Schwartz, Fong & Vasicek, Longstaff & Schwartz), Cox-Ingersoll-Ross Equilibrium model, Spot rate model with automatic yield (Ho & Lee, Hull & White), Heath-Jarrow-Morton forward rate model, Brace-Gatarek-Musiela (BGM) LIBOR market model.

Price Models: Constant price model, General deterministic price model, Lognormal price model, Poisson price model.

Volatility Models: Constant Volatility Models, General Deterministic Volatility model, Hull & White Stochastic model of the Variance, Hoston Stochastic Volatility model.

Monte Carlo Princing Engine: Evaluate price estimate accordance to number of iterations or maximum expected error. Evaluate the standard deviation of the price estimate, and the minimum/maximum expected price for a given confidence level.

This product also has the following technology aspects:

3-in-1: .NET, COM, and XML Web services - 3 DLLs, 3 API Docs,...

Extensive Client Examples (C#, VB, C++,...)

ADO Mediator

Compatible Containers (VS 6, VS.NET, Office 97/2000/XP/2003, C++Builder, Delphi 3-2005).. |

|

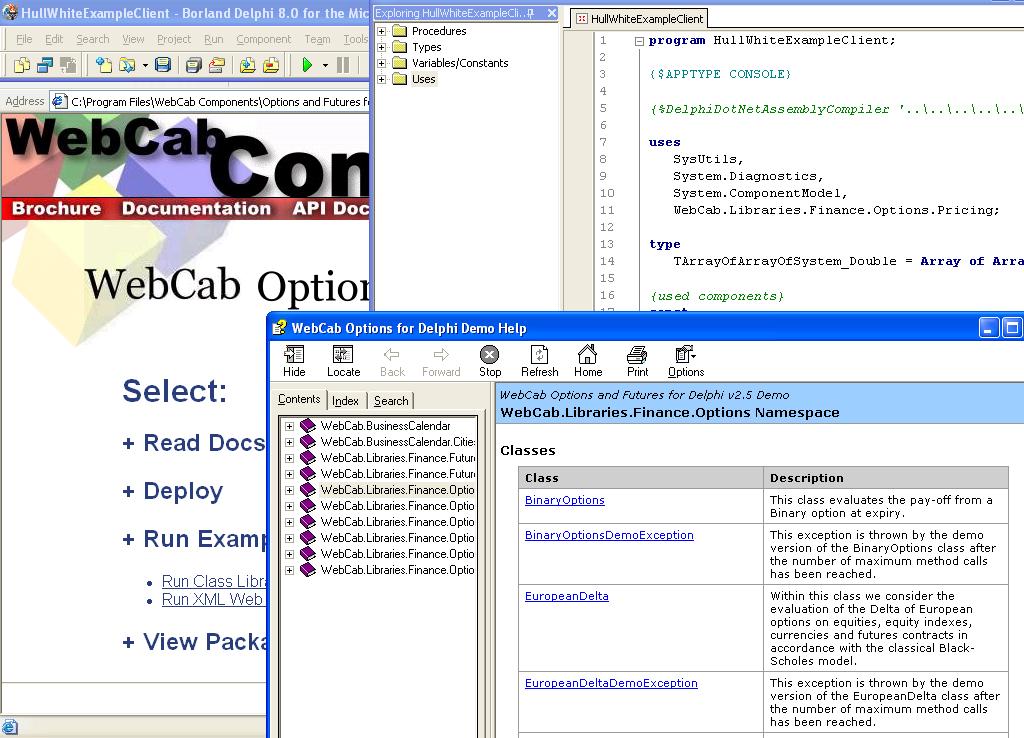

| 3-in-1: COM, .NET and XML Web service Interest derivatives pricing framework: set contract, set vol/price/interest models and run MC. We also cover: Treasury's, Price/Yield, Zero Curve, Fixed-Interest bonds, Forward rates/FRAs, Duration and Convexity..

|

|

| 3-in-1: .NET, COM and XML Web service Components for pricing option and futures contracts using Monte Carlo and Finite Difference techniques. General MC pricing framework included: wide range of contracts, price, interest and vol models... |

|

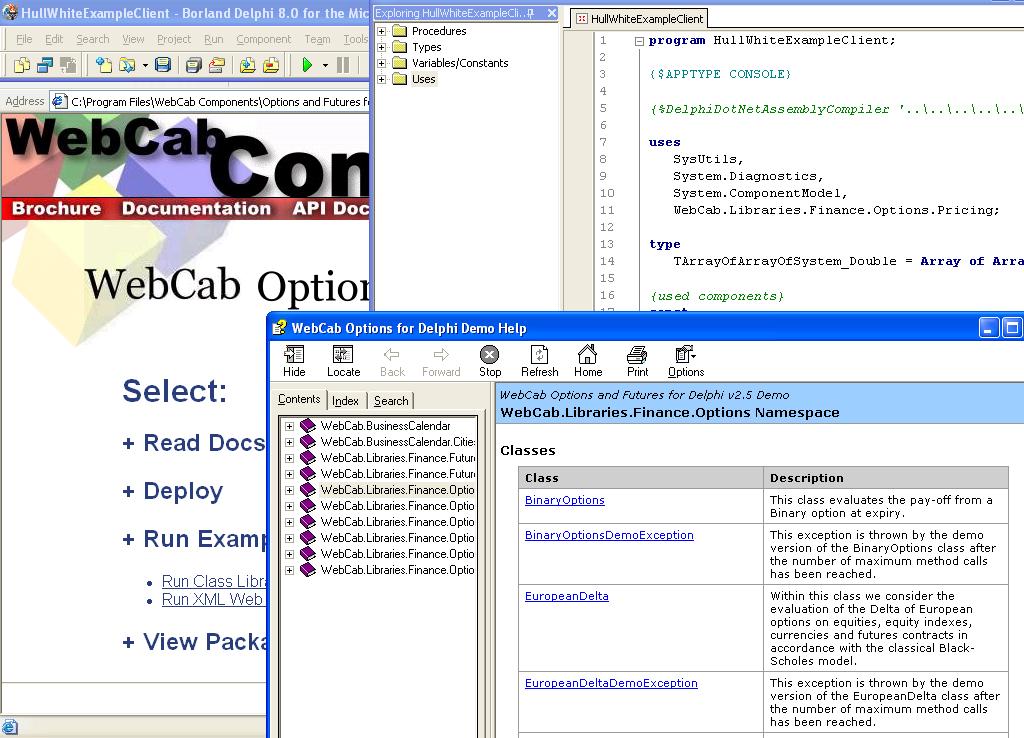

| 3-in-1: .NET, COM and XML Web service Components for pricing option and futures contracts using Monte Carlo and Finite Difference techniques. General Monte Carlo pricing framework: wide range of contracts, price, interest and vol models. Price European, Asian, American, Lookback, Bermuda and Binary Options using Analytic, Monte Carlo and Finite Difference in accordance with a number of vol, price, volatility and rate models.

General Pricing Framework offers the following predefined Models and Contracts:

Contracts: Asian Option, Binary Option, Cap, Coupon Bond, Floor, Forward Start stock option, Lookback Option, Ladder Option, Vanilla Swap, Vanilla Stock Option, Zero Coupon Bond, Barrier Option, Parisian Option, Parasian Option, Forward and Future.

Interest Rate Models: Constant Spot Rate, Constant (in time) Yield curve, One factor stochastic models (Vasicek, Black-Derman-Toy (BDT), Ho & Lee, Hull and White), Two factor stochastic models (Breman & Schwartz, Fong & Vasicek, Longstaff & Schwartz), Cox-Ingersoll-Ross Equilibrium model, Spot rate model with automatic yield (Ho & Lee, Hull & White), Heath-Jarrow-Morton forward rate model, Brace-Gatarek-Musiela (BGM) LIBOR market model.

Price Models: Constant price model, General deterministic price model, Lognormal price model, Poisson price model.

Volatility Models: Constant Volatility Models, General Deterministic Volatility model, Hull & White Stochastic model of the Variance, Hoston Stochastic Volatility model.

Monte Carlo Princing Engine: Evaluate price estimate accordance to number of iterations or maximum expected error. Evaluate the standard deviation of the price estimate, and the minimum/maximum expected price for a given confidence level.

This product also has the following technology aspects:

3-in-1: .NET, COM, and XML Web services - 3 DLLs, 3 API Docs,...

Extensive Client Examples (Delphi for .NET, C#, VB.NET)

ADO Mediator

Compatible Containers (Delphi 3-8, Delphi 2005, C++Builder..

|

|

| This online course shows you how to build a sophisticated automated stock trading model using MS Excel... |

|

| Financial Charting Component is powerful charting compoent and is designed for stock charting specifically. It has strikng visual effects, great interactivity, zoom and pan functions. It is built with other most frequently used graphic shapes...

|

|

| Point & Figure Charts software is a stock analysis tool for individual investors and traders to identify buy-and-sell signals. The premier feature is Point & Figure Chart that is implemented with classic scale and custom scale. and much more... |

|

Related search : rice modelmodels constant,hull & whitefactor stochastic modelsmonte carloprice modelmodels constant,hull & whitefactor stochastic modelsmonte carloprice modelmodels constant,hull & whitefactor stochastic modelspdf guidestock tradingautomatedOrder by Related

- New Release

- Rate

|

|